Course Curriculum

| Section 01: Welcome to the Course! | |||

| Welcome to this Course on Capital Raising for Entrepreneurs | 00:05:00 | ||

| Section 02: Let’s Get Started Right Away | |||

| What types of investors are out there? | 00:12:00 | ||

| What is the difference between Venture Capital and Private Equity? | 00:14:00 | ||

| What stage is your business at? | 00:14:00 | ||

| How Much Money Should You Raise? | 00:04:00 | ||

| What is the Difference between a Pre Money and Post Money Valuation | 00:01:00 | ||

| Section 03: An introduction to Startups | |||

| Startup Essentials – Markets | 00:05:00 | ||

| Startup Essentials – Profits | 00:06:00 | ||

| Startup Essentials – Business Plan | 00:05:00 | ||

| Startup Essentials – Capital | 00:05:00 | ||

| Startup Essentials – Value | 00:06:00 | ||

| Startup Essentials – Investors | 00:05:00 | ||

| Section Text Summary PDF for Download | 00:16:00 | ||

| Section 04: Do You Really Understand Venture Capitalists? | |||

| Do You Really Understand Venture Capitalists? | 00:14:00 | ||

| Do You Match Their Criteria? | 00:18:00 | ||

| Four Key Questions to Ask? | 00:03:00 | ||

| Understanding the Investment Process | 00:18:00 | ||

| Section 05: How to Understand If You Are Talking to the Right Investor | |||

| Introduction: Understanding Your VCs; A Case Study | 00:02:00 | ||

| What Type Of Investor Are You Talking To? | 00:12:00 | ||

| A Detailed Breakdown of Different Types of Private Equity Funds | 00:05:00 | ||

| What is their Ideal Investment Size? | 00:06:00 | ||

| What Stage Do They Invest At? | 00:03:00 | ||

| Stage of Business Financing from a VC Perspective | 00:05:00 | ||

| How Can You Define Venture Capitalists’ Sector Interest? | 00:03:00 | ||

| What Part Does Geography Play? | 00:06:00 | ||

| What is meant by Style and Structure? | 00:05:00 | ||

| What is meant by Key Investment Criteria? | 00:03:00 | ||

| Section Summary: Do You Understand VCs? | 00:14:00 | ||

| Section 06: Looking at Things from the VC Point of View | |||

| What Factors are important to VCs? | 00:10:00 | ||

| Considering Valuation from the VC Perspective | 00:06:00 | ||

| How do Investors value a Startup? | 00:12:00 | ||

| How do Investors Value a Series an Investment? | 00:07:00 | ||

| How do VCs look at your Market? | 00:07:00 | ||

| What do VCs think about your Product or Service? | 00:09:00 | ||

| How Do VCs Evaluate You and your Management Team? | 00:10:00 | ||

| Why is Exit Strategy important to VCs? | 00:07:00 | ||

| Why are Barriers to Entry important? | 00:07:00 | ||

| How do VCs consider your Competition? | 00:04:00 | ||

| What Financial Information is important to VCs? | 00:03:00 | ||

| What is the typical VC Decision Making Process? | 00:09:00 | ||

| Seed Stage VC’s Decision Tree | 00:05:00 | ||

| Project: Evaluate Your Own Startup | 00:02:00 | ||

| Section 07: What Questions Should You Ask Venture Capital? | |||

| 36 Questions to Ask a VC Overview | 00:02:00 | ||

| 36 Questions to Ask a VC Part 1 – Fund Profile | 00:03:00 | ||

| 36 Questions to Ask a VC Part 2 – Investment Style | 00:02:00 | ||

| 36 Questions to Ask a VC Part 3 – Deal Flow | 00:03:00 | ||

| 36 Questions to Ask a VC Part 4 – Process | 00:03:00 | ||

| 36 Questions to Ask a VC Part 5 – Structure | 00:03:00 | ||

| 36 Questions to Ask a VC Part 6 – Value Added | 00:03:00 | ||

| Key Questions That You Can Expect a VC to Ask You | 00:06:00 | ||

| Section 08: How to Email Venture Capital and Angel Investors | |||

| How to Write an Introductory Email to an Investor | 00:11:00 | ||

| The Power of Forwardable Emails | 00:02:00 | ||

| How NOT to email investors | 00:04:00 | ||

| How to Find an Investors Email Address (if you don’t have it) | 00:09:00 | ||

| Section 09: What You Need to Know to Present Your Business to Investors | |||

| How to Deliver a 60 Second Pitch | 00:08:00 | ||

| The Sixteen Magic Words Investors Want to Hear from You | 00:21:00 | ||

| How to Write a One Pager for a VC | 00:18:00 | ||

| Top Tips on Preparing to Pitch Investors | 00:12:00 | ||

| How to prepare a Pitch Deck for an Investor | 00:19:00 | ||

| How to Prepare a Business Plan and Executive Summary | 00:02:00 | ||

| How to Prepare a Financing Strategy | 00:02:00 | ||

| Key Elements of the Financial Plan | 00:11:00 | ||

| Section 10: Startup Fundraising and Pitching | |||

| Startup Fundraising – Getting Started | 00:09:00 | ||

| 19 Reasons VCs May Say No | 00:09:00 | ||

| Communicating Your Vision | 00:03:00 | ||

| The Business Plan; Overview and Communication | 00:07:00 | ||

| Business Plan Core Contents | 00:08:00 | ||

| The Financial Plan | 00:16:00 | ||

| The Pitching Process and Investor Returns | 00:08:00 | ||

| Post Mortems | 00:07:00 | ||

| What are Investors looking for? | 00:07:00 | ||

| Section 11: How to Deliver Winning Presentation to Investors | |||

| What do Investors Want? | 00:13:00 | ||

| Outline Presentation Checklist | 00:19:00 | ||

| What is TAM, SAM and SOM and why are they important? | 00:15:00 | ||

| AIDA – Why Pitching VCs Is Like Buying a Car! | 00:11:00 | ||

| Selling Your Pitch | 00:13:00 | ||

| Pitching to Win! | 00:13:00 | ||

| How to Run the Meeting | 00:14:00 | ||

| Outline Management Presentation | 00:15:00 | ||

| Defending Your Plan | 00:17:00 | ||

| ACTIVITY: Create Your Own Presentation | 00:01:00 | ||

| Section 12: Managing the Fundraising Process | |||

| How do Venture Capitalists Source Deals? | 00:06:00 | ||

| How to find Angel Investors | 00:08:00 | ||

| How to Find Venture Capital Investors | 00:02:00 | ||

| BONUS: How to Find a Venture Capital Investor for Your Tech Company | 00:09:00 | ||

| What Happens Next? The Investment Process | 00:08:00 | ||

| How to Manage the Investment Process | 00:08:00 | ||

| Section 13: Venture Capital Term Sheets | |||

| What is a Term Sheet Part 1 | 00:08:00 | ||

| What is a Term Sheet Part 2 | 00:11:00 | ||

| Key Concepts in Term Sheets | 00:10:00 | ||

| What is a Term Sheet Trying to Achieve? | 00:10:00 | ||

| 26 Key Components in VC Term Sheets 1 -5 | 00:08:00 | ||

| 26 Key Components in VC Term Sheets 6 – 10 | 00:08:00 | ||

| 26 Key Components in VC Term Sheets 11 – 15 | 00:08:00 | ||

| 26 Key Components in VC Term Sheets 16 – 20 | 00:30:00 | ||

| 26 Key Components in VC Term Sheets 21 – 26 | 00:09:00 | ||

| Negotiating Term Sheets: Entrepreneurs Perspective | 00:09:00 | ||

| Negotiating Term Sheets: VC Perspective | 00:11:00 | ||

| Negotiating Term Sheets: Mutual Issues of Concern | 00:02:00 | ||

| US Style VC Term Sheet Example | 00:12:00 | ||

| Section 14: Equity Crowdfunding for Entrepreneurs | |||

| What is Crowdfunding? | 00:03:00 | ||

| The Advantages of Equity Crowdfunding for the Investor | 00:14:00 | ||

| The Disadvantages of Crowdfunding for the Investor | 00:12:00 | ||

| Section 15: How to Evaluate a Crowdfunding Opportunity? | |||

| Introduction to How to Evaluate a Crowdfunding Opportunity | 00:01:00 | ||

| The Key Data You Need To Know For Any Opportunity | 00:03:00 | ||

| Let’s take a look now at Management Skills | 00:03:00 | ||

| Management Experience is important as well… | 00:02:00 | ||

| You must take a look at the Management’s Commitment! | 00:03:00 | ||

| Product Market | 00:03:00 | ||

| So, how unique is this product? | 00:03:00 | ||

| What is the Competition like? | 00:03:00 | ||

| Does the Product have (all important) traction? | 00:03:00 | ||

| How profitable is the product and therefore the investment? | 00:03:00 | ||

| Let’s take a look at the most critical factor, Cash Flow! | 00:03:00 | ||

| Finally, let’s see what this all means for your Investment Returns | 00:03:00 | ||

| Discover how you can turn this information into a Methodology! | 00:02:00 | ||

| Let’s Summarise this Section with the 10 Most Important Factors | 00:02:00 | ||

| Section 16: Introduction with Andrew Monk, CEO iolight about his Crowdfunding Experience | |||

| Introduction | 00:05:00 | ||

| Why did you go for Equity Crowdfunding? | 00:04:00 | ||

| What did you do early on to ensure success? | 00:03:00 | ||

| How did you go about lining up your 25% | 00:02:00 | ||

| Did you set about trying to collect email addresses? | 00:03:00 | ||

| Let’s have the Investor Conversation | 00:06:00 | ||

| Are there any mistakes looking back you may have made? | 00:08:00 | ||

| So what is it like by the end of week three? | 00:07:00 | ||

| How does Crowdcube get the money to you? | 00:09:00 | ||

| Are there any other tools you used that you can recommend? | 00:04:00 | ||

| Bonus: Discussion about Campaign Videos | 00:04:00 | ||

| Bonus: Detailed Notes on this Section to Download – PDF Attached | 00:16:00 | ||

| Section 17: Summary and Wrap Up | |||

| Course Summary and Wrap Up | 00:03:00 | ||

| Section 18: Additional File | |||

| Additional File | 00:00:00 | ||

| Certificate and Transcript | |||

| Order Your Certificates or Transcripts | 00:00:00 | ||

Investment Banking: Venture Capital Fundraising for Startups

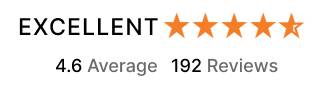

Course Reviews

No Reviews found for this course.

Gift this course

Gift this course