Course Curriculum

| Anti-Money Laundering and Fraud Management | |||

| Module 1: Introduction to the Course | 00:30:00 | ||

| Module 2: Definition of Money Laundering | 00:30:00 | ||

| Module 3: Responsibility & Oversight | 00:45:00 | ||

| Module 4: Risk Based Approach | 00:30:00 | ||

| Module 5: Customer Due Diligence (CDD) | 01:00:00 | ||

| Module 6: Suspicious Activity Reporting | 01:00:00 | ||

| Module 7: Record Keeping | 00:15:00 | ||

| Module 8: Training and Awareness | 00:20:00 | ||

| Module 9: GLOSSARY | 00:30:00 | ||

| Module 10: Legislative Summaries – Proceeds of Crime Act 2002 | 00:15:00 | ||

| Module 11: Outsourcing, Subcontracting and Secondments | 00:20:00 | ||

| Module 12: Client Verification | 00:15:00 | ||

| Module 13: Decisions and Risk Factors | 00:30:00 | ||

| Mock Exam | |||

| Mock Exam – Anti-Money Laundering and Fraud Management Course – Level 3 | 00:20:00 | ||

| Final Exam | |||

| Final Exam – Anti-Money Laundering and Fraud Management Course – Level 3 | 00:20:00 | ||

| Certificate and Transcript | |||

| Order Your Certificates or Transcripts | 00:00:00 | ||

Anti-Money Laundering and Fraud Management Course - Level 3

Gift this course

Gift this course

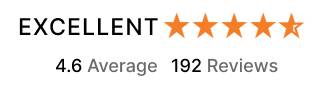

Joseph Nichols

I am extremely satisfied and grateful to them. I think this is a must-do course for the people related to money laundering. Superb!

Harold Moss

They put a reasonable effort and dedication on creating the course, I must say. It gave me second-hand experience which will help me a lot ahead, I guess, nobody is going to regret doing this, I’m sure!

Wilma Sherrill

It came out to be a wonderfully practical guide to me. The modules are well-designed and communicative. I appreciate you added a glossary to it. Lovely!

Christopher Mack

This is a perfectly balanced course, thanks for the excellent service.

Scott Nestor

This course was quite easy to navigate at the same time it was able to answer all the queries I had. Recommended for all those who are involved in this career and to the students too.

Grace Lopez

It covers almost everything I was looking for. Directed me really well on designing risk analyses and came to know every type of risks, quite handy, I would recommend it.

My opinion of the course.

I have just completed the course and i am happy to say that i passed. The reading material was a lot harder than i thought it was going to be. But i am glad i stuck with the course and now have a much better understanding of Anti-Money Laundering and Fraud Management.

Thank you for everything.

AML training

Great material. Went into appropriate depth.

Did not cover CDD when you cannot meet the client face to face.

I have left comments on the course, and we’ll see if these responses are ever answered!