Overview

This Anti-Money Laundering course will introduce you to the vital issue regarding anti-money laundering, why it is considered as a crime or why and how criminal organisations launder money, and how to detect money laundering activities.

During the course, you will learn about the anti-money laundering act, including the principles and different approaches to anti-money laundering. You will also learn to identify various risks associated from a perspective of money laundering abuse and discover ways to be proactive and vigilant in your fight against money launderers, making a meaningful contribution to the financial institution or accounting firm you work with.

On completion of the course on anti-money laundering course, you will be able to establish your career in the fast-growing field of anti-money laundering (AML) and become a certified anti-money laundering specialist or analyst.

Who is this Course for?

This Anti-Money Laundering course is suitable for anyone who want to gain extensive knowledge, potential experience and professional skills in the related field.

Entry Requirement:

- This course is available to all learners, of all academic backgrounds.

- Learners should be aged 16 or over to undertake the qualification.

- Good understanding of English language, numeracy and ICT are required to attend this course.

Method of Assessment:

Upon completion of the course, you will be required to sit for an online multiple-choice quiz based assessment, which will determine whether you have passed the course (60% pass mark). The test will be marked immediately and results will be published instantly.

CPD Certificate from Course Gate

At the successful completion of the course, you can obtain your CPD certificate from us. You can order the PDF certificate for £9 and the hard copy for £15. Also, you can order both PDF and hardcopy certificates for £22.

Certification

After successfully completing the course, you will be able to obtain the certificates. You can claim a PDF certificate by paying a little processing fee of £2. There is an additional fee to obtain a hardcopy certificate which is £9.

Course Curriculum

| Anti-Money Laundering | |||

| Module 1: Introduction to the Course | 00:30:00 | ||

| Module 2: Definition of Money Laundering | 00:30:00 | ||

| Module 3: Responsibility & Oversight | 00:45:00 | ||

| Module 4: Risk Based Approach | 00:30:00 | ||

| Module 5: Customer Due Diligence (CDD) | 01:00:00 | ||

| Module 6: Suspicious Activity Reporting | 01:00:00 | ||

| Module 7: Record Keeping | 00:15:00 | ||

| Module 8: Training and Awareness | 00:20:00 | ||

| Module 9: GLOSSARY | 00:30:00 | ||

| Module 10: Legislative Summaries – Proceeds of Crime Act 2002 | 00:15:00 | ||

| Module 11: Outsourcing, Subcontracting and Secondments | 00:20:00 | ||

| Module 12: Client Verification | 00:15:00 | ||

| Module 13: Decisions and Risk Factors | 00:30:00 | ||

| Mock Exam | |||

| Mock Exam – Anti-Money Laundering | 00:20:00 | ||

| Final Exam | |||

| Final Exam – Anti-Money Laundering | 00:20:00 | ||

| Certificate and Transcript | |||

| Order Your Certificates or Transcripts | 00:00:00 | ||

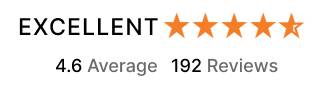

Course Reviews

No Reviews found for this course.

Gift this course

Gift this course